American healthcare is well known for its extreme cost and worst outcomes among industrialized (such as the 38 OECD member) countries, and beyond that to be remarkably opaque. The high cost of prescription drugs contributes, and little has been done to change that except for the government passing the Affordable Insulin Now Act at the end of 2022, enacted in 2023. But in January 2022 Mark Cuban launched Cost Plus Drugs that has transformed how many Americans can get their prescriptions filled at a fraction of the prevailing prices, bypassing pharmacy benefit managers (PBMs) that control 80% of US prescriptions. That was just the beginning of a path of creative destruction (disruptive innovation, after Schumpeter) of many key components American healthcare that Cuban is leading, with Cost Plus Marketplace, Cost Plus Wellness and much more to come. He certainly qualifies as a master disrupter: “someone who is a leader in innovation and is not afraid to challenge the status quo.”

Below is a video clip from our conversation dealing with insurance companies. Full videos of all Ground Truths podcasts can be seen on YouTube here. The current one is here. If you like the YouTube format, please subscribe! The audios are also available on Apple and Spotify.

Transcript with External links to Audio

(00:07):

Hello, it's Eric Topol with Ground Truths, and I have our special phenomenal guest today, Mark Cuban, who I think you know him from his tech world contributions and Dallas Mavericks, and the last few years he's been shaking up healthcare with Cost Plus Drugs. So Mark, welcome.

Mark Cuban (00:25):

Thanks for having me, Eric.

Eric Topol (00:27):

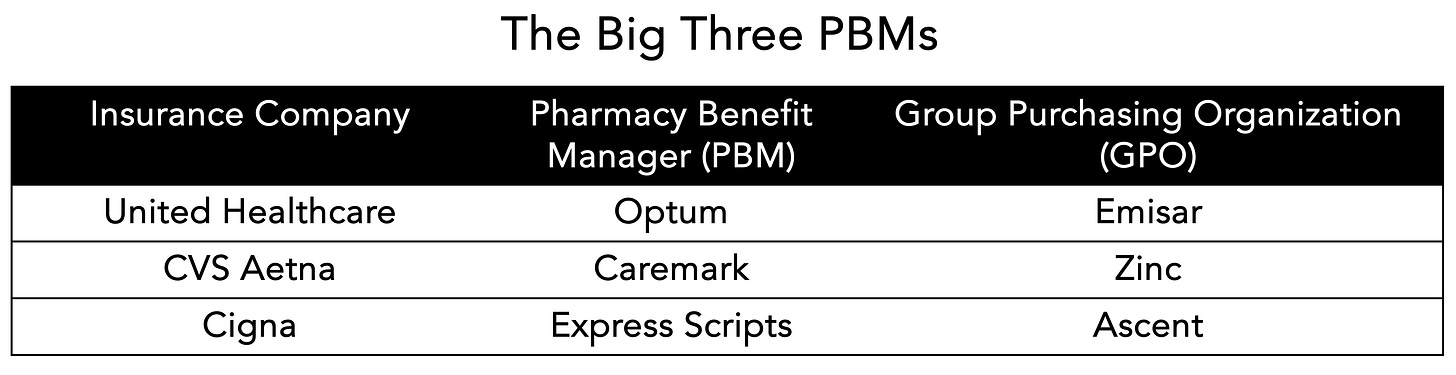

Yeah, I mean, what you're doing, you’ve become a hero to millions of Americans getting them their medications at a fraction of the cost they're used to. And you are really challenging the PBM industry, which I've delved into more than ever, just in prep for our conversation. It's just amazing what this group of companies, namely the three big three CVS Caremark, Optum of UnitedHealth and Express Scripts of Cigna with a market of almost $600 billion this year, what they're doing, how can they get away with all this stuff?

Inner Workings of Pharmacy Benefit Managers

Mark Cuban (01:03):

I mean, they're just doing business. I really don't blame them. I blame the people who contract with them. All the companies, particularly the bigger companies, the self-insured companies, where the CEO really doesn't have an understanding of their healthcare or pharmacy benefits. And so, the big PBMs paid them rebates, which they think is great if you're a CEO, when in reality it's really just a loan against the money spent by your sickest employees, and they just don't understand that. So a big part of my time these days is going to CEOs and sitting with them and explaining to them that you're getting ripped off on both your pharmacy and your healthcare side.

Eric Topol (01:47):

Yeah, it's amazing to me the many ways that they get away with this. I mean, they make companies sign NDAs. They're addicted to rebates. They have all sorts of ways a channel of funds to themselves. I mean, all the things you could think of whereby they even have these GPOs. Each of these companies has a group purchasing organization (I summarized in the Table below).

Mark Cuban (02:12):

Yeah, which gives them, it's crazy because with those GPOs. The GPO does the deal with the pharmacy manufacturer. Then the GPO also does the deal with the PBM, and then the PBM goes to the self-insured employer in particular and says, hey, we're going to pass through all the rebates. But what they don't say is they've already skimmed off 5%, 10%, 20% or more off the top through their GPO. But that's not even the worst of it. That's just money, right? I mean, that's important, but I mean, even the biggest companies rarely own their own claims data.

Mark Cuban (02:45):

Now think about what that means. It means you can't get smarter about the wellness of your employees and their families. You want to figure out the best way to do GLP-1s and figure out how to reduce diabetes, whatever it may be. You don't have that claims data. And then they don't allow the companies to control their own formularies. So we've seen Humira biosimilars come out and the big PBMs have done their own version of the biosimilar where we have a product called Yusimry, which is only $594 a month, which is cheaper than the cheapest biosimilar that the big three are selling. And so, you would think in a normal relationship, they would want to bring on this new product to help the employer. No, they won't do it. If the employer asks, can I just add Cost Plus Drugs to my network? They'll say no, every single time.

Mark Cuban (03:45):

Their job is not to save the employer money, particularly after they've given a rebate. Because once they give that loan, that rebate to the employer, they need to get that money back. It's not a gift. It's a loan and they need to have the rebates, and we don't do rebates with them at all. And I can go down the list. They don't control the formula. They don't control, you mentioned the NDAs. They can't talk to manufacturers, so they can't go to Novo or to Lilly and say, let's put together a GLP-1 wellness program. All these different things that just are common sense. It's not happening. And so, the good news is when I walk into these companies that self-insured and talk to the CEO or CFO, I'm not asking them to do something that's not in their best interest or not in the best interest of the lives they cover. I'm saying, we can save you money and you can improve the wellness of your employees and their families. Where's the downside?

Eric Topol (04:40):

Oh, yeah. Yeah. And the reason they can't see the claims is because of the privacy issues?

Mark Cuban (04:46):

No, no. That's just a business decision in the contract that the PBMs have made. You can go and ask. I mean, you have every right to your own claims. You don't need to have it personally identified. You want to find out how many people have GLP-1s or what are the trends, or God forbid there's another Purdue Pharma thing going on, and someone prescribing lots of opioids. You want to be able to see those things, but they won't do it. And that's only on the sponsor side. It's almost as bad if not worse on the manufacturer side.

Eric Topol (05:20):

Oh, yeah. Well, some of the work of PBMs that you've been talking about were well chronicled in the New York Times, a couple of major articles by Reed Abelson and Rebecca Robbins: The Opaque Industry Secretly Inflating Prices for Prescription Drugs and The Powerful Companies Driving Local Drugstores Out of Business. We'll link those because I think some people are not aware of all the things that are going on in the background.

Mark Cuban (05:39):

You see in their study and what they reported on the big PBMs, it's crazy the way it works. And literally if there was transparency, like Cost Plus offers, the cost of medications across the country could come down 20%, 30% or more.

Cost Plus Drugs

Eric Topol (05:55):

Oh, I mean, it is amazing, really. And now let's get into Cost Plus. I know that a radiologist, Alex Oshmyansky contacted you with a cold email a little over three years ago, and you formed

Cost Plus Drugs on the basis of that, right?

Mark Cuban (06:12):

Yep, that's exactly what happened.

Eric Topol (06:15):

I give you credit for responding to cold emails and coming up with a brilliant idea with this and getting behind it and putting your name behind it. And what you've done, so you started out with something like 110 generics and now you're up well over 1,200 or 2,500 or something like that?

Mark Cuban (06:30):

And adding brands. And so, started with 111. Now we're around 2,500 and trying to grow it every single day. And not only that, just to give people an overview. When you go to www.costplusdrugs.com and you put in the name of your medication, let's just say it's tadalafil, and if it comes up. In this case, it will. It'll show you our actual cost, and then we just mark it up 15%. It's the same markup for everybody, and if you want it, we'll have a pharmacist check it. And so, that's a $5 fee. And then if you want ship to mail order, it's $5 for shipping. And if you want to use our pharmacy network, then we can connect you there and you can just pick it up at a local pharmacy.

Eric Topol (07:10):

Yeah, no, it's transparency. We don't have a lot of that in healthcare in America, right?

Mark Cuban (07:15):

No. And literally, Eric, the smartest thing that we did, and we didn't expect this, it's always the law of unintended consequences. The smartest thing we did was publish our entire price list because that allowed any company, any sponsor, CMS, researchers to compare our prices to what others were already paying. And we've seen studies come out saying, for this X number of urology drugs, CMS would save $3.6 billion a year. For this number of heart drugs at this amount per year, for chemotherapy drugs or MS drugs this amount. And so, it's really brought attention to the fact that for what PBMs call specialty drugs, whether there's nothing special about them, we can save people a lot of money.

Eric Topol (08:01):

It's phenomenal. As a cardiologist, I looked up a couple of the drugs that I'm most frequently prescribed, just like Rosuvastatin what went down from $134 to $5.67 cents or Valsartan it went down from $69 to $7.40 cents. But of course, there's some that are much more dramatic, like as you mentioned, whether it's drugs for multiple sclerosis, the prostate cancer. I mean, some of these are just thousands and thousands of dollars per month that are saved, brought down to levels that you wouldn't think would even be conceivable. And this has been zero marketing, right?

Mark Cuban (08:42):

Yeah, none. It's all been word of mouth and my big mouth, of course. Going out there and doing interviews like this and going to major media, but it's amazing. We get emails and letters and people coming up to us almost single day saying, you saved my grandma's life. You saved my life. We weren't going to be able to afford our imatinib or our MS medication. And it went from being quoted $2,000 a month to $33 a month. It's just insane things like that that are still happening.

Eric Topol (09:11):

Well, this is certainly one of the biggest shakeups to occur in US healthcare in years. And what you've done in three years is just extraordinary. This healthcare in this country is with its over 4 trillion, pushing $5 trillion a year of expenditure.[New CMS report this week pegs the number at $4.867 trillion for 2023]

Mark Cuban (09:30):

It's interesting. I think it's really fixable. This has been the easiest industry to the disrupt I've ever been involved in. And it's not even close because all it took was transparency and not jacking up margins to market. We choose to use a fixed margin markup. Some choose to price to market, the Martin Shkreli approach, if you will. And just by being transparent, we've had an impact. And the other side of it is, it's the same concept on the healthcare side. Transparency helps, but to go a little field of pharmacy if you want. The insane part, and this applies to care and pharmacy, whatever plan we have, whether it's for health or whether it's for pharmaceuticals, there's typically a deductible, typically a copay, and typically a co-insurance.

Insurance Companies

Mark Cuban (10:20):

The crazy part of all that is that people taking the default risk, the credit risk are the providers. It's you, it's the hospital, it's the clinics that you work for. Which makes no sense whatsoever that the decisions that you or I make for our personal insurance or for the companies we run, or if we work for the government, what we do with Medicare or Medicare Advantage, the decisions we all make impacts the viability of providers starting with the biggest hospital systems. And so, as a result, they become subprime lenders without a car or a house to go after if they can't collect. And so, now you see a bunch of people, particularly those under the ACA with the $9,000, the bronze plans or $18,000 out-of-pocket limits go into debt, significant medical debt. And it's unfortunate. We look at the people who are facing these problems and think, well, it must be the insurance companies.

Mark Cuban (11:23):

It's actually not even the insurance companies. It's the overall design of the system. But underneath that, it's still whoever picks the insurance companies and sets plans that allow those deductibles, that's the core of the problem. And until we get to a system where the providers aren't responsible for the credit for defaults and dealing with all that credit risk, it's almost going to be impossible to change. Because when you see stories like we've all seen in news of a big healthcare, a BUCA healthcare (Blue Cross Blue Shield (BCBS), UnitedHealth, Cigna, and Aetna/CVS) plan with all the pre-authorizations and denials, typically they're not even taking the insurance risk. They're acting as the TPA (third party administrator) as the claims processor effectively for whoever hired them. And it goes back again, just like I talked about before. And as long as CMS hires or allows or accepts these BUCAs with these plans for Medicare for the ACA (Affordable care Act), whatever it may be, it's not going to work. As long as self-insured employers and the 50 million lives they cover hire these BUCAs to act as the TPAs, not as insurance companies and give them leeway on what to approve and what to authorize and what not to authorize. The system's going to be a mess, and that's where we are today.

Academic Health System Partnerships

Eric Topol (12:41):

Yeah. Well, you've been talking of course to employers and enlightening them, and you're also enlightening the public, of course. That's why you have millions of people that are saving their cost of medications, but recently you struck a partnership with Penn Medicine. That's amazing. So is that your first academic health system that you approached?

Cost Plus Marketplace

Mark Cuban (13:00):

I don't know if it was the first we approached, but it was certainly one of the biggest that we signed. We've got Cost Plus Marketplace (CPM) where we make everything from injectables to you name it, anything a hospital might buy. But again, at a finite markup, we make eight and a half percent I think when it's all said and done. And that saves hospital systems millions of dollars a year.

Eric Topol (13:24):

Yeah. So that's a big change in the way you're proceeding because what it was just pills that you were buying from the pharma companies, now you're actually going to make injectables and you're going to have a manufacturing capability. Is that already up and going?

Mark Cuban (13:39):

That's all up and going as of March. We're taking sterile injectables that are on the shortage list, generic and manufacturing them in Dallas using a whole robotics manufacturing plant that really Alex created. He's the rocket scientist behind it. And we’re limited in capacity now, we're limited about 2 million vials, but we'll sell those to Cost Plus Marketplace, and we'll also sell those direct. So Cost Plus Marketplace isn't just the things we manufacture. It's a wide variety of products that hospitals buy that we then have a minimal markup, and then for the stuff we manufacture, we'll sell those to direct to like CHS was our first customer.

Eric Topol (14:20):

Yeah, that's a big expansion from going from the pills to this. Wow.

Mark Cuban (14:24):

It's a big, big expansion, but it goes to the heart of being transparent and not being greedy, selling on a markup. And ourselves as a company, being able to remain lean and mean. The only way we can sell at such a low markup. We have 20 employees on the Cost Plus side and 40 employees involved with the factories, and that's it.

Eric Topol (14:46):

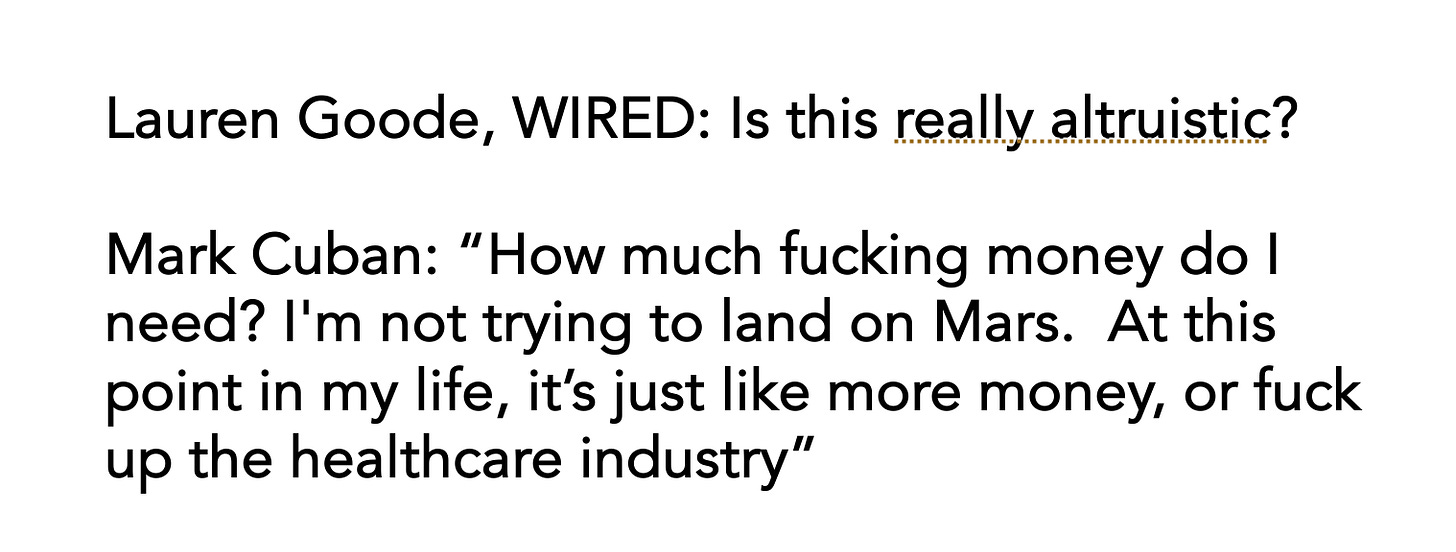

Wow. So with respect to, you had this phenomenal article and interview with WIRED Magazine just this past week. I know Lauren Goode interviewed you, and she said, Mark, is this really altruistic and I love your response. You said, “how much fucking money do I need? I'm not trying to land on Mars.” And then you said, “at this point in my life, it’s just like more money, or fuck up the healthcare industry.” This was the greatest, Mark. I mean, I got to tell you, it was really something.

Mark Cuban (15:18):

Yeah.

Eric Topol (15:19):

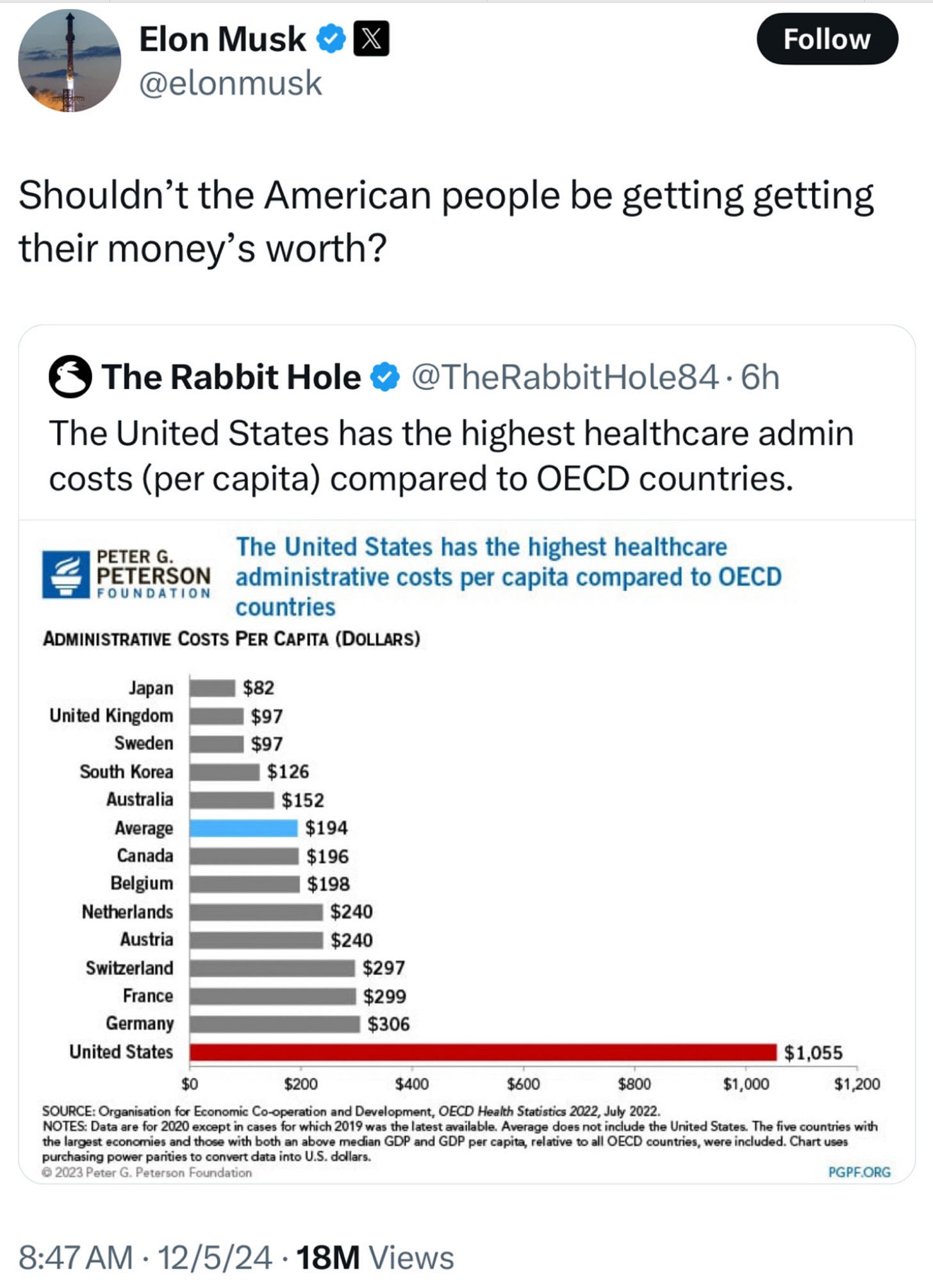

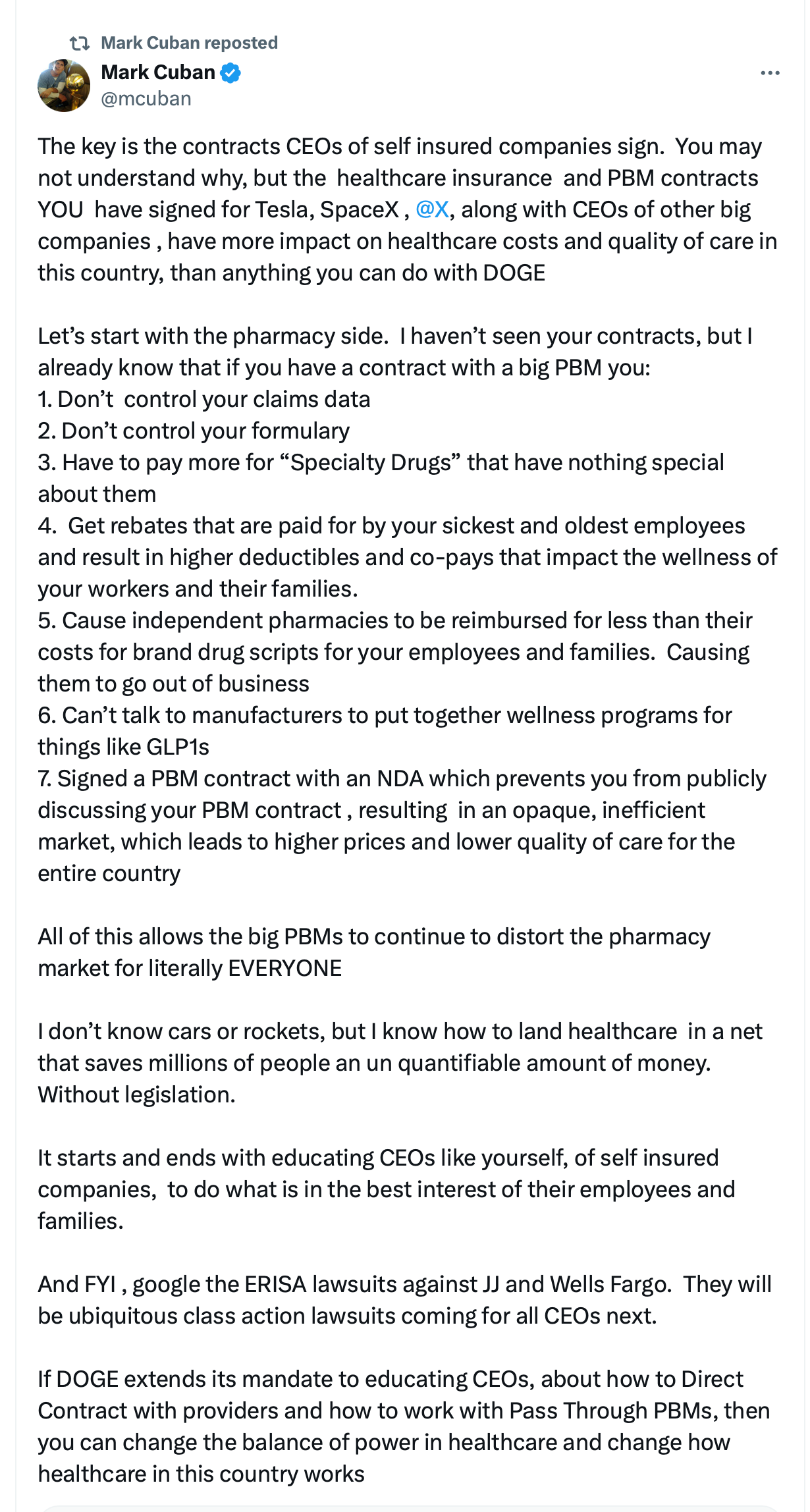

Well, in speaking of that, of course, the allusion to a person we know well, Elon. He posted on X/Twitter in recent days , I think just three or four days ago, shouldn't the American people be getting their money's worth? About this high healthcare administration costs where the US is completely away from any other OECD country. And as you and I know, we have the worst outcomes and the most costs of all the rich countries in the world. There's just nothing new here. Maybe it's new to him, but you had a fabulous response on both X and Bluesky where you went over all these things point by point. And of course, the whole efforts that you've been working on now for three years. You also mentioned something that was really interesting that I didn't know about were these ERISA lawsuits[Employee Retirement Income Security Act (ERISA) of 1974.] Can you tell us about that?

ERISA Lawsuits

Mark Cuban (16:13):

Yeah, that's a great question, Eric. So for self-insured companies in particular, we have a fiduciary responsibility on a wellness and on a financial basis to offer the members, your employees and their families the best outcomes at the best price. Now, you can't guarantee best outcomes, but you have to be able to explain the choices you made. You don't have to pick the cheapest, but again, you have to be able to explain why you made the choices that you did. And because a lot of companies have been doing, just like we discussed earlier, doing deals on the pharmacy side with just these big PBMs, without accounting for best practices, best price, best outcomes, a couple companies got sued. Johnson and Johnson and Wells Fargo were the first to get sued. And I think that's just the beginning. That's just the writing on the wall. I think they'll lose because they just dealt with the big pharmacy PBMs. And I think that's one of the reasons why we're so busy at Cost Plus and why I'm so busy because we're having conversation after conversation with companies and plenty of enough lawyers for that matter who want to see a price list and be able to compare what they're paying to what we sell for to see if they're truly living up to that responsibility.

Eric Topol (17:28):

Yeah, no, that's a really important thing that's going on right now that I think a lot of people don't know about. Now, the government of the US think because it's the only government of any rich country in the world, if not any country that doesn't negotiate prices, i.e., CMS or whatever. And only with the recent work of insulin, which is a single one drug, was there reduction of price. And of course, it's years before we'll see other drugs. How could this country not negotiate drugs all these years where every other place in the world they do negotiate with pharma?

Mark Cuban (18:05):

Because as we alluded to earlier, the first line in every single pharmaceutical and healthcare contract says, you can't talk about this contract. It’s like fight club. The number one rule of fight club is you can't talk about fight club, and it's really difficult to negotiate prices when it's opaque and everything's obfuscated where you can't really get into the details. So it's not that we're not capable of it, but it's just when there's no data there, it's really difficult because look, up until we started publishing our prices, how would anybody know?

Mark Cuban (18:39):

I mean, how was anybody going to compare numbers? And so, when the government or whoever started to negotiate, they tried to protect themselves and they tried to get data, but those big PBMs certainly have not been forthcoming. We’ve come along and publish our price list and all that starts to change. Now in terms of the bigger picture, there is a solution there, as I said earlier, but it really comes down to talking to the people who make the decisions to hire the big insurance companies and the big PBMs and telling them, no, you're not acting in your own best interest. Here's anybody watching out there. Ask your PBM if they can audit. If you can audit rather your PBM contract. What they'll tell you is, yeah, you can, but you have to use our people. It's insane. And that's from top to bottom. And so, I'm a big believer that if we can get starting with self-insured employers to act in their own best interest, and instead of working with a big PBM work with a pass-through PBM. A pass-through PBM will allow you to keep your own claims, own all your own data, allow you to control your own formulary.

Mark Cuban (19:54):

You make changes where necessary, no NDA, so you can't talk to manufacturers. All these different abilities that just seem to make perfect sense are available to all self-insured employers. And if the government, same thing. If the government requires pass-through PBMs, the price of medications will drop like a rock.

Eric Topol (20:16):

Is that possible? You think that could happen?

Mark Cuban (20:19):

Yes. Somebody's got to understand it and do it. I'm out there screaming, but we will see what happens with the new administration. There's nothing hard about it. And it's the same thing with Medicare and Medicare Advantage healthcare plans. There's nothing that says you have to use the biggest companies. Now, the insurance companies have to apply and get approved, but again, there's a path there to work with companies that can reduce costs and improve outcomes. The biggest challenge in my mind, and I'm still trying to work through this to fully understand it. I think where we really get turned upside down as a country is we try to avoid fraud from the provider perspective and the patient perspective. We're terrified that patients are going to use too much healthcare, and like everybody's got Munchausen disease.

Mark Cuban (21:11):

And we're terrified that the providers are going to charge too much or turn into Purdue Pharma and over-prescribe or one of these surgery mills that just is having somebody get surgery just so they can make money. So in an effort to avoid those things, we ask the insurance companies and the PBMs to do pre-authorizations, and that's the catch 22. How do we find a better way to deal with fraud at the patient and provider level? Because once we can do that, and maybe it's AI, maybe it's accepting fraud, maybe it's imposing criminal penalties if somebody does those things. But once we can overcome that, then it becomes very transactional. Because the reality is most insurance companies aren't insurance companies. 50 million lives are covered by self-insured employers that use the BUCAs, the big insurance companies, but not as insurance companies.

Eric Topol (22:07):

Yeah, I was going to ask you about that because if you look at these three big PBMs that control about 80% of the market, not the pass-throughs that you just mentioned, but the big ones, they each are owned by an insurance company. And so, when the employer says, okay, we're going to cover your healthcare stuff here, we're going to cover your prescriptions there.

Mark Cuban (22:28):

Yeah, it's all vertically integrated.

Mark Cuban (22:36):

And it gets even worse than that, Eric. So they also own specialty pharmacies, “specialty pharmacies” that will require you to buy from. And as I alluded to earlier, a lot of these medications like Imatinib, they'll list as being a specialty medication, but it's a pill. There's nothing special about it, but it allows them to charge a premium. And that's a big part of how the PBMs make a lot of their money, the GPO stuff we talked about, but also forcing an employer to go through the specialty mail order company that charges an arm and the leg.

Impact on Hospitals and Procedures

Eric Topol (23:09):

Yeah. Well, and the point you made about transparency, we've seen this of course across US healthcare. So for example, as you know, if you were to look at what does it cost to have an operation like let's say a knee replacement at various hospitals, you can find that it could range fivefold. Of course, you actually get the cost, and it could be the hospital cost, and then there's the professional cost. And the same thing occurs for if you're having a scan, if you're having an MRI here or there. So these are also this lack of transparency and it's hard to get to the numbers, of course. There seems to be so many other parallels to the PBM story. Would you go to these other areas you think in the future?

Mark Cuban (23:53):

Yeah, we're doing it now. I'm doing it. So we have this thing called project dog food, and what it is, it's for my companies and what we've done is say, look, let's understand how the money works in healthcare.

Mark Cuban (24:05):

And when you think about it, when you go to get that knee done, what happens? Well, they go to your insurance company to get a pre-authorization. Your doctor says you need a knee replacement. I got both my hips replaced. Let's use that. Doctor says, Mark, you need your hips replaced. Great, right? Let's set up an appointment. Well, first the insurance company has to authorize it, okay, they do or they don't, but the doctor eats their time up trying to deal with the pre-authorization. And if it's denied, the doctor's time is eaten up and an assistance's time is eaten up. Some other administrator's time is eaten up, the employer's time is eaten up. So that's one significant cost. And then from there, there's a deductible. Now I can afford my deductible, but if there is an individual getting that hip replacement who can't afford the deductible, now all of a sudden you're still going to be required to do that hip replacement, most likely.

Mark Cuban (25:00):

Because in most of these contracts that self-insured employers sign, Medicare Advantage has, Medicare has, it says that between the insurance company and the provider, in this case, the hospital, you have to do the operation even if the deductibles not paid. So now the point of all this is you have the hospital in this case potentially accumulating who knows how much bad debt. And it's not just the lost amount of millions and millions and billions across the entire healthcare spectrum that's there. It's all the incremental administrative costs. The lawyers, the benefits for those people, the real estate, the desk, the office space, all that stuff adds up to $10 billion plus just because the hospitals take on that credit default risk. But wait, there's more. So now the surgery happens, you send the bill to the insurance company. The insurance company says, well, we're not going to pay you. Well, we have a contract. This is what it says, hip replacement's $34,000. Well, we don't care first, we're going to wait. So we get the time value of money, and then we're going to short pay you.

Mark Cuban (26:11):

So the hospital gets short paid. So what do they have to do? They have to sue them or send letters or whatever it is to try to get their money. When we talk to the big hospital systems, they say that's 2%. That's 2% of their revenue. So you have all these associated credit loss dollars, you've got the 2% of, in a lot of cases, billions and billions of dollars. And so, when you add all those things up, what happens? Well, what happens is because the providers are losing all that money and having to spend all those incremental dollars for the administration of all that, they have to jack up prices.

Eric Topol (26:51):

Yeah. Right.

Mark Cuban (26:53):

So what we have done, we've said, look for my companies, we're going to pay you cash. We're going to pay you cash day one. When Mark gets that hip replacement, that checks in the bank before the operation starts, if that's the way you want it. Great, they're not going to have pre-authorizations. We're going to trust you until you give us a reason not to trust you. We're not short paying, obviously, because we're paying cash right there then.

Mark Cuban (27:19):

But in a response for all that, because we're cutting out all those ancillary costs and credit risk, I want Medicare pricing. Now the initial response is, well, Medicare prices, that's awful. We can't do it. Well, when you really think about the cost and operating costs of a hospital, it's not the doctors, it's not the facilities, it's all the administration that cost all the money. It's all the credit risks that cost all the money. And so, if you remove that credit risk and all the administration, all those people, all that real estate, all those benefits and overhead associated with them, now all of a sudden selling at a Medicare price for that hip replacement is really profitable.

Eric Topol (28:03):

Now, is that a new entity Cost Plus healthcare?

Mark Cuban (28:07):

Well, it's called Cost Plus Wellness. It's not an entity. What we're going to do, so the part I didn't mention is all the direct contracts that we do that have all these pieces, as part of them that I just mentioned, we're going to publish them.

Eric Topol (28:22):

Ah, okay.

Mark Cuban (28:23):

And you can see exactly what we've done. And if you think about the real role of the big insurances companies for hospitals, it's a sales funnel.

Getting Rid of Insurance Companies

Eric Topol (28:33):

Yeah, yeah. Well, in fact, I really was intrigued because you did a podcast interview with Andrew Beam and the New England Journal of Medicine AI, and in that they talked about getting rid of the insurers, the insurance industry, just getting rid of it and just make it a means test for people. So it's not universal healthcare, it's a different model that you described. Can you go over that? I thought it was fantastic.

Mark Cuban (29:00):

Two pieces there. Let's talk about universal healthcare first. So for my companies, for our project dog food for the Mark Cuban companies, if for any employee or any of the lives we cover, if they work within network, anybody we have the direct contract with its single-payer. They pay their premiums, but they pay nothing else out of pocket. That's the definition of single-payer.

Eric Topol (29:24):

Yeah.

Mark Cuban (29:25):

So if we can get all this done, then the initial single-payers will be self-insured employers because it'll be more cost effective to them to do this approach. We hope, we still have to play it all through. So that's part one. In terms of everybody else, then you can say, why do we need insurance companies if they're not even truly acting as insurance companies? You're not taking full risk because even if it's Medicare Advantage, they're getting a capitated amount per month. And then that's getting risk adjusted because of the population you have, and then there's also an index depending on the location, so there's more or less money that occurs then. So let's just do what we need to do in this particular case, because the government is effectively eliminating the risk for the insurance company for the most part. And if you look at the margins for Medicare Advantage, I was just reading yesterday, it's like $1,700 a year for the average Medicare Advantage plan. So it's not like they're taking a lot of risk. All they're doing is trying to deny as many claims as they can.

Eric Topol (30:35):

Deny, Deny. Yeah.

Mark Cuban (30:37):

So instead, let's just get somebody who's a TPA, somebody who does the transaction, the claims processing, and whoever's in charge. It could be CMS, can set the terms for what's accepted and what's denied, and you can have a procedure for people that get denied that want to challenge it. And that's great, there's one in place now, but you make it a little simpler. But you take out the economics for the insurance company to just deny, deny, deny. There's no capitation. There's no nothing.

Mark Cuban (31:10):

The government just says, okay, we're hiring this TPA to handle the claims processing. It is your job. We're paying you per transaction.

Mark Cuban (31:18):

You don't get paid more if you deny. You don't get paid less if you deny. There's no bonuses if you keep it under a certain amount, there's no penalties If you go above a certain amount. We want you just to make sure that the patient involved is getting the best care, end of story. And if there's fraud involved as the government, because we have access to all that claims data, we're going to introduce AI that reviews that continuously.

Mark Cuban (31:44):

So that we can see things that are outliers or things that we question, and there's going to mean mistakes, but the bet was, if you will, where we save more and get better outcomes that way versus the current system and I think we will. Now, what ends up happening on top of that, once you have all that claims data and all that information and everybody's interest is aligned, best care at the best price, no denials unless it's necessary, reduce and eliminate fraud. Once everybody's in alignment, then as long as that's transparent. If the city of Dallas decides for all the lives they cover the 300,000 lives they cover between pharmacy and healthcare, we can usually in actuarial tables and some statistical analysis, we can say, you know what, even with a 15% tolerance, it's cheaper for us just to pay upfront and do this single-pay program, all our employees in the lives we cover, because we know what it's going to take.

Mark Cuban (32:45):

If the government decides, well, instead of Medicare Advantage the way it was, we know all the costs. Now we can say for all Medicare patients, we'll do Medicare for all, simply because we have definitive and deterministic pricing. Great. Now, there's still going to be outlier issues like all the therapies that cost a million dollars or whatever. But my attitude there is if CMS goes to Lilly, Novo, whoever for their cure for blindness that's $3.4 million. Well, that's great, but what we'll say is, okay, give us access to your books. We want to know what your breakeven point is. What is that breakeven point annually? We'll write you a check for that.

Eric Topol (33:26):

Yeah.

Mark Cuban (33:27):

If we have fewer patients than need that, okay, you win. If we have more patients than need that, it's like a Netflix subscription with unlimited subscribers, then we will have whatever it is, because then the manufacturer doesn't lose money, so they can't complain about R&D and not being able to make money. And that's for the CMS covered population. You can do a Netflix type subscription for self-insured employers. Hey, it's 25 cents per month per employee or per life covered for the life of the patent, and we'll commit to that. And so, now all of a sudden you get to a point where healthcare starts becoming not only transparent but deterministic.

Eric Topol (34:08):

Yeah. What you outline here in these themes are extraordinary. And one of the other issues that you are really advocating is patient empowerment, but one of the problems we have in the US is that people don't own their data. They don't even have all their data. I expect you'd be a champion of that as well.

Mark Cuban (34:27):

Well, of course. Yeah. I mean, look, I've got into arguments with doctors and public health officials about things like getting your own blood tested. I've been an advocate of getting my own blood tested for 15 years, and it helped me find out that I needed thyroid medication and all of these things. So I'm a big advocate. There's some people that think that too much data gives you a lot of false positives, and people get excited in this day and age to get more care when it should only be done if there are symptoms. I'm not a believer in that at all. I think now, particularly as AI becomes more applicable and available, you'll be able to be smarter about the data you capture. And that was always my final argument. Either you trust doctors, or you don't. Because even if there's an aberrational TSH reading and minus 4.4 and it's a little bit high, well the doctor's going to say, well, let's do another blood test in a month or two. The doctor is still the one that has to write the prescription. There's no downside to trusting your doctor in my mind.

Eric Topol (35:32):

And what you're bringing up is that we're already seeing how AI can pick up things even in the normal range, the trends long before a clinician physician would pick it up. Now, last thing I want to say is you are re-imagining healthcare like no one. I mean, there's what you're doing here. It started with some pills and it's going in a lot of different directions. You are rocking it here. I didn't even know some of the latest things that you're up to. This seems to be the biggest thing you've ever done.

Mark Cuban (36:00):

I hope so.

Mark Cuban (36:01):

I mean, like we said earlier, what could be better than people saying our healthcare system is good. What changed? That Cuban guy.

Eric Topol (36:10):

Well, did you give up Shark Tank so you could put more energy into this?

Mark Cuban (36:16):

Not really. It was more for my kids.

Eric Topol (36:19):

Okay, okay.

Mark Cuban (36:20):

They go hand in hand, obviously. I can do this stuff at home as opposed to sitting on a set wondering if I should invest in Dude Wipes again.

Eric Topol (36:28):

Well, look, we're cheering for you. This is, I've not seen a shakeup in my life in American healthcare like this. You are just rocking. It's fantastic.

Mark Cuban (36:37):

Everybody out there that's watching, check out www.costplusdrugs.com, check out Cost Plus Marketplace, which is business.costplusdrugs.com and just audit everything. What I'm trying to do is say, okay, if it's 1955 and we're starting healthcare all over again, how would we do it? And really just keep it simple. Look to where the risk is and remove the risk where possible. And then it comes down to who do you trust and make sure you trust but verify. Making sure there aren't doctors or systems that are outliers and making sure that there aren't companies that are outliers or patients rather that are outliers. And so, I think there's a path there. It's not nearly as difficult, it's just starting them with corporations, getting those CEOs to get educated and act in their own best interest.

Eric Topol (37:32):

Well, you're showing us the way. No question. So thanks so much for joining, and we'll be following this with really deep interest because you're moving at high velocity, and thank you.

**************************************************

Thank you for reading, listening and subscribing to Ground Truths.

If you found this fun and informative please share it!

All content on Ground Truths—its newsletters, analyses, and podcasts, are free, open-access.

Paid subscriptions are voluntary. All proceeds from them go to support Scripps Research. Many thanks to those who have contributed—they have greatly helped fund our summer internship programs for the past two years. I welcome all comments from paid subscribers and will do my best to respond to each of them and any questions.

Thanks to my producer Jessica Nguyen and to Sinjun Balabanoff for audio and video support at Scripps Research.

Footnote

The PBMS (finally) are under fire—2 articles from the past week